Loss of healthcare coverage, increased insurance premiums, longer emergency room wait times, smoggy air, higher energy prices, and a deepening hunger crisis are all what we can expect from the budget reconciliation bill.

by Michael Nelson and Sarah Hunkins, WORC’s Washington, D.C. representatives

During the 2024 election we heard a lot of promises–that inflation would go down, that jobs and prosperity were around the corner, that our healthcare would be protected, that we would enter a new American golden age. With a governing trifecta, the GOP had the chance to at least try and keep those promises, but their major legislative initiative, the “One Big Beautiful Bill (OBBB),” doesn’t come even close to fulfilling them. In fact, it breaks several of those promises, proving they were empty to begin with. Many now wonder what this means for those who call the Rocky Mountain West and the Great Plains home.

This post looks at the impact this bill will have on the eight states the WORC network covers. We won’t mince words: This law could very well devastate our towns, farms, personal health, and environment–all to give the wealthiest Americans a tax break.

Essentially, Congress has:

- Cut billions of dollars in federal support for the hungry, the sick, and the poor, as well as for renewable energy development.

- Handed fossil fuel companies a raft of new subsidies, streamlined permits, and access to public lands.

- Exploded the national debt by $3 trillion.

- And funneled that money to pay for tax cuts for the super wealthy and corporations.

When you consider the loss of healthcare coverage, increased insurance premiums, longer emergency room wait times, smoggy air, higher energy prices, and a deepening hunger crisis, is the bill’s annual average tax break of $1789 for middle income households through 2030 worth it? Is it worth it when $6 out of every $10 of the bill’s tax cuts go to the top 20% of income earners, households making more than $217,000 per year (as the nonpartisan tax policy center explains)?

What comes next? What does all of this mean? How do we make sense of these colossal changes that have been made on a party-line vote with the slimmest of majorities? This law is BAD for our states, but the leaders who were elected to represent our region in the House and Senate overwhelmingly supported it. It’s going to take a long-term, multi-state effort to turn this ship around.

At WORC we are committed to grassroots, bottom-up community organizing. We are a network of grassroots groups that are ready to take on the hard work of building a regional mass movement to make the West and Midwest a safe, healthy, and prosperous place to live. We understand that the greatest of movement achievements start with the small wins. From the Nebraska Organizing Project winning Spanish language emergency services in Norfolk, to Dakota Rural Action stopping carbon pipeline projects, to the Idaho Organization of Resource Councils raising money to support farmworkers, we are building momentum together.

So we urge you not to despair. Double down, get local, sign up for action alerts, and join your local WORC member group. Then get to know your neighbors, grab a clipboard, and let’s get organized so we can one day overturn this massive mistake. The work starts here, with making sure our neighbors understand what a colossal betrayal the OBBB is to the American people.

What does the OBBB do?

Oil and gas

The OBBB reversed many oil and gas reforms that were passed in the Inflation Reduction Act. This included lowering the royalty rates on federally owned oil and gas from 16.67% to 12.5%, which will reduce by 25% the amount of money coming into the federal treasury and going to oil and gas-producing states, ultimately leading to reduced funding for infrastructure projects and social programs such as public education and healthcare access.

The law also eliminated the IRA’s $5-per-acre fee that companies paid to nominate lands for oil and gas leasing. This fee disincentivized companies from nominating parcels they weren’t serious about developing.

The OBBB also requires the BLM to make more than 200 million acres of federal land open to oil and gas leasing whenever a company nominates them for a sale.That’s more than double the size of Montana. This severely undermines BLM’s discretion to defer or deny parcels offered for lease, which the agency has done in the past when there were controversies and public outcry around a sale. While Sen. Mike Lee’s (R-UT) attempt to sell off public lands was removed from the OBBB, we were left with provisions that essentially hand over our public lands to oil and gas companies.

Federal onshore lease sales were also significantly expanded under the OBBB, with four required sales per year in Colorado, Montana, North Dakota, New Mexico, Nevada, Oklahoma, Utah, and Wyoming. Each sale must offer at least 50% of nominated lands, with all nominated lands offered within 18 months. This massive expansion of oil and gas leasing on our public lands and minerals, combined with the massive staffing shortage already a problem at the BLM, will take a terrible toll on our environment, health, and safety, and will exacerbate the growing orphaned well crisis in this country.

The OBBB also targeted the Methane Emission Reduction Program (MERP), delaying its implementation for 10 years. MERP was created to disincentivize oil and gas operators from emitting unnecessary amounts of methane into the atmosphere by providing financial and technical assistance to oil and gas companies so that they can better monitor and measure their emissions. It also imposes fees on oil and gas facilities that have excess methane emission pollution. MERP is a triple win for Westerners–it cuts natural gas waste, limits air pollution, and provides additional revenue to states. According to the Congressional Budget Office the methane polluter fee was projected to generate $8.47 billion in revenue from 2026 to 2031. The delay of implementation for this critical program will do lasting damage to air quality, public health, and state economies.

In Colorado, for example, 320,000 people, including 23,000 children under the age of five, live within a half mile of active oil and gas operations. (For more information on populations located near oil and gas development, check out this useful resource.) Research from 2023 on North Dakota, which has some of the worst air quality in the country due to the massive expansion of oil and gas development in the last two decades, found that methane wasted from the state’s 17,600 active wells translated into $43.3 million in lost tax and royalty revenue for the state, including $18.6 million in lost revenue for the Three Affiliated Tribes.

Coal

Due to the rise of cleaner and more affordable forms of energy, the coal market has experienced a steep decline in the last decade. Provisions passed in the OBBB attempt to prop up the dying industry.

Royalties on federal coal from surface mines were reduced by 40%, from 12.5% down to 7% until 2034. States receive 50% of the royalties gained from coal development on public minerals. Analysis done by Wyoming Public Radio found that, as a result of this royalty reduction, Wyoming is set to lose $50 million annually. And because coal is one of Wyoming’s top industries, the loss of revenue will take money away from schools, healthcare, roads, and many other programs the state relies on.

The law also significantly expands coal leasing. This comes just a year after the Biden administration halted coal leasing in the Powder River Basin in Wyoming and Montana, citing loss of market demands and impacts to air quality. A provision in the OBBB directs the Interior Secretary to make available all recoverable coal to leasing, no less than four million acres in the Lower 48 and Alaska. The BLM is now poised to offer a major Wyoming coal lease for sale for the first time since 2012.

Another provision that aims to expedite coal leasing is one that authorizes companies to expand current mining operations without submitting a federal permit if those operations are located within a certain proximity to state and private minerals. This means that no further environmental analysis must be done before a company expands its mine, which is a serious departure from the robust NEPA analysis that was required in the past. This is a serious concern for communities in close proximity to coal development. It exacerbates the harm that coal mining has already done to communities and their water, air, and land.

The OBBB also implements a credit for companies producing metallurgical coal, a credit that will be funded by tax dollars. This provision gives coal companies a 2.5% tax credit for the cost of producing metallurgical coal regardless of whether the production occurs inside or outside of the United States. It also designates metallurgical coal as a critical mineral, which usually implies it is critical for economic and national security, and provides for streamlined permitting and environmental review.

Given the drastic market shifts away from coal, the coal provisions within the OBBB are unlikely to jumpstart the coal industry and instead will prop up marginal companies and delay reclamation of defunct coal mines.

NEPA

The National Environmental Policy Act has faced many attacks over the last nine months, including through passage of the OBBB. This bedrock environmental law has protected communities and the environment since the 1970s by ensuring that projects proposed on public lands or minerals go through a comprehensive environmental review and public participation process to guarantee unintended consequences are limited. This law is absolutely critical, especially for communities in the West, where the majority of public lands and minerals are located. Unfortunately, Congress and the administration are fixated on “streamlining” the permitting process, which ultimately means severely weakening NEPA. From both sides of the aisle, there’s a focus on a “need for speed” during this massive energy transition, although studies have shown that the main obstacle to more expedient NEPA permitting is inadequate staffing at agencies, which could be resolved if Congress appropriated adequate funding to the agencies.

The OBBB made significant changes to NEPA. If project sponsors pay 125% of estimated cost of preparing the NEPA documents, then timelines are sped up. Environmental assessments (EAs) must be completed within six months, while environmental impact statements (EISs) must be completed within a year. This comes two years after the Fiscal Responsibility Act passed, shrinking timelines and requiring EAs be completed in one year and EISs in two years. Before, these environmental reviews took however long it took agencies to complete the analysis, but the average EAs would take one year and EISs approximately three years. The OBBB also allows project sponsors to prepare their own NEPA documents, which will inevitably result in false reporting, limited analysis, and industry biases, and will ultimately harm communities and the environment.

We have already seen projects fast-tracked within our region, including the Bull Mountains Mine in Montana, where an EIS was released for the expansion of the mine without giving the public any opportunity to weigh in and without any analysis of impacts the mine will have on water that a local subdivision and nearby ranches rely on.

Keep up to date with grassroots organizing in the West with WORC’s newsletter.

Renewable energy

According to the 2024 United States Energy & Employment Report, the clean energy industry– which includes solar, wind, energy efficiency, transmission, and distribution–employs nearly 300,000 people in the WORC region. Between 2021 and 2023, the eight states in our network saw an average 5.12% increase in jobs in these fields. And the Energy Information Administration (EIA) has reported steady increases in generation and storage capacity of electricity from these sources over the past few years. In short, the West has experienced a renewable energy boom over the past few years. This law intends to torpedo that.

The OBBB eliminates the clean and renewable tax credits provided in the Inflation Reduction Act (IRA), which developers have been able to use in recent years to make building out solar, wind, and storage more affordable. The bill also put onerous “foreign entities of concern” restrictions on renewable energy projects.

Moreover, the law rescinds all remaining clean energy funds from the IRA, with $27 billion rescinded from the Greenhouse Gas Reduction Fund, which funds the Solar for All program. The bill also claws back the remaining $90 million for the Climate Pollution Reduction Grants, as well as the final $20 million for the Environmental and Climate Justice Program. Although most of the funding from these programs has already been allocated, the administration has attempted to freeze and rescind funds from renewable energy programs like the Solar for All grants. Their future remains perilous.

Electric co-ops, nonprofit organizations, companies, and homeowners have either begun or have invested heavily in bringing energy projects online with the help of these federal investments. But this law pulls the rug out from under them by putting unrealistic timelines and arbitrary requirements to qualify before these credits and programs disappear. According to the Princeton University ZERO Lab, these changes will result in average households paying 13% more for energy by 2035. The jobs gained during the green energy boom will surely dissipate, along with the economic growth associated with this burgeoning industry.

Medicaid and rural hospital closures

The OBBB cut an unprecedented $1 trillion from healthcare programs nationwide (while increasing the national debt by $3.4 trillion). The cuts are achieved through making Medicare harder to access. The Congressional Budget Office (CBO) estimates that 10 million people will lose access to healthcare nationwide as a result of these changes. These reforms include stricter work requirements, more frequent eligibility checks, restrictions for immigrants, and reduction of the state provider tax.

One way that the OBBB reduces healthcare spending is by putting onerous paperwork in between eligible recipients and their benefits. Under the new law, recipients who don’t qualify for an exemption will need to prove that they are working or looking for work in order to stay enrolled. That change will kick 2.6 million people off of Medicaid nationwide, including those who are laid off and looking for work or have limited access to transportation. It also includes those who are full-time caregivers to their elderly or infirmed family members.

Even if you aren’t on Medicare, we will all potentially pay the prices, as Alan O’Neil, CEO of Unity Medical Center in Grafton, North Dakota, explains. “The potential for patients to lose coverage means they go through the emergency department and are unable to pay, which leads to what the health care world calls ‘bad debt,’ he told the Grand Folks Herald. “Hospitals adjust pricing to keep doors open, so a buildup of bad debt will increase costs for everyone.”

There is a small fund set aside in the law to prop up rural hospitals. In North Dakota, for instance, that amounts to about $500 million over the next five years. But even with the fund, the odds are stacked against the viability and survival of many rural hospitals.

According to the Center for Healthcare Quality and Payment Reform (CHQPR), 90 rural hospitals in our states are at risk of closure because of these changes, 29 of them at imminent risk within two to three years despite the support provided in the OBBB. Approximately one in three hospitals across our region could close. This means long drives for care, worse health outcomes, and the loss of health care jobs that are often employment anchors.

Here is a state-by-state breakdown of our region provided by CHQPR:

- Colorado: 11 hospitals at risk of closing (26%), three at immediate risk in next two-three years (7%)

- Idaho: Eight hospitals at risk of closing (29%), one at immediate risk in next two-three years (4%)

- Montana: 18 hospitals at risk of closing (33%), five at immediate risk in next two-three years (9%)

- Nebraska: Six hospitals at risk of closing (8%), three at immediate risk in next two-three years (4%)

- North Dakota: 13 hospitals at risk of closing (33%), four at immediate risk in next two-three years (10%)

- South Dakota: Nine hospitals at risk of closing (18%), three at immediate risk in next two-three years (6%)

- Wyoming: Seven hospitals at risk of closing (27%), four at immediate risk in next two-three years (15%)

Nutrition and hunger

The OBBB made drastic changes to the Supplemental Nutrition Assistance Program (SNAP), which feeds millions of people every day. The new law cuts $187 billion from the program (approximately 20% of the total program). The lionshare of these cuts are made by shifting the cost of paying for the program to states.

For many years the federal government paid 100% of the SNAP dollars that people use to pay for groceries, while states would cover 50% of SNAP’s administrative costs. Under the new law, states are forced to cover 5-15% of the benefits to recipients, based on the state’s error rate. A state’s error rate is a score derived from the amount of overpayments and underpayments in the state’s SNAP program. Even though WORC states are on average more accurate than the national average (7.29 vs 10.93) Colorado, Montana, North Dakota, and Oregon will now be forced to pony up 5-15% of their SNAP payments based on 2024 data unless they can lower their error rate.

Below is an estimate of what these states will need to pay to keep their current SNAP programs running based on USDA data tables.

- Colorado, with a 2024 error rate of 9.97 and SNAP cost share of 10%, will see $130,317,270 in new state spending.

- Montana, with a 2024 error rate of 8.89 and SNAP cost share of 10%, will see $16,944,687 in new state spending.

- North Dakota, with a 2024 error rate of 7.91 and SNAP cost share of 5%, will see $5,572,445 in new state spending.

- Oregon, with a 2024 error rate of 14.06 and SNAP cost share of 15%, will see $239,487,786 in new state spending.

On top of the changes made to payment cost shares based on error rates, the OBBB will increase the state’s administrative cost share to 75% from 50%. These new cost share requirements go into effect on October 1, 2027. This clever accounting trick is how the proponents of the bill claim that the bill doesn’t cut SNAP. But we know that once it comes time for state legislatures to review their budgets, this new consideration will force them into a choice of increasing state taxes, cutting SNAP, or cutting some other state-provided services.

On top of these budgetary shifts to states, the OBBB will also make it harder to access and stay on SNAP. Proponents claim that they are only kicking people off of SNAP who don’t need it (able-bodied adults without dependents), but under these new restrictions, a parent who is caring for their teenage children full time would now be required to meet the work requirements or be kicked off the program. So would a 62-year-old who is able bodied but temporarily sick, as well as full time caregivers for disabled parents and dependents.

The law now states that parents can only claim SNAP benefits until their children reach 14 years old, and that our elders who could, up until now, access nutrition support starting at age 55 now must wait until 65, otherwise they are subject to work requirements. According to CBO at least 4 million people will see their benefits eliminated or severely reduced as a result of these changes, including children, elders, and veterans. And this data also estimates that 40 million more will see significant changes and/or reductions in their benefits.

All of this will result in more hunger, especially for tribal nations, the elderly, and children. Furthermore, this will hurt grocers, farmers, and ranchers as SNAP provides a significant boost to consumer-buying power.

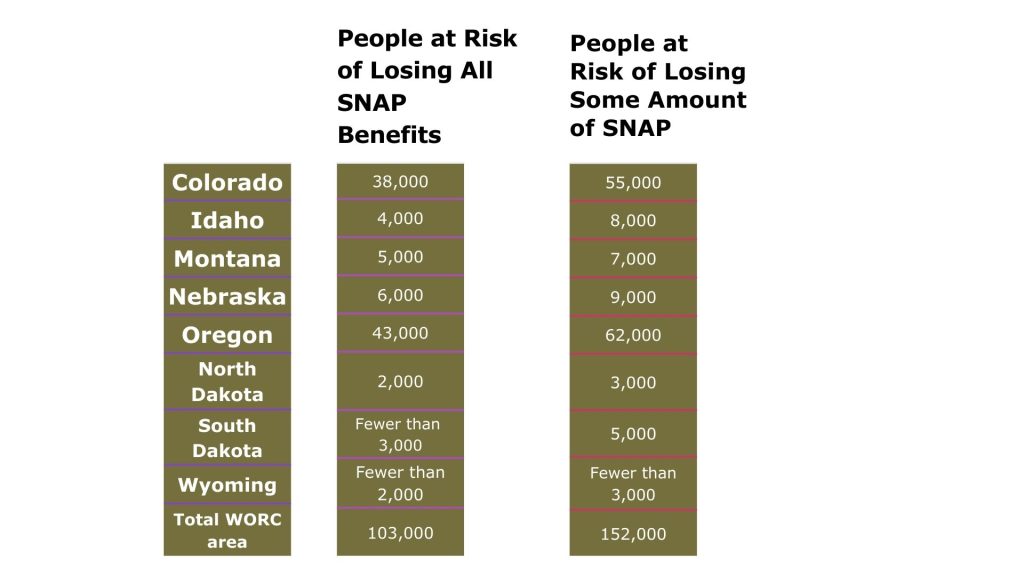

Below is a table from the CBO that provides state-by-state data on how many people are estimated to lose SNAP benefits or have benefits reduced in the next 10 years.

Learn more:

A Devastating Bill Becomes Law

45Q Tax Credit: Subsidizing Waste and Fraud Through Carbon Capture

The Administration’s Fixation on Coal Makes No Sense

Yes, I want to help WORC elevate Western voices and hold decision-makers accountable!