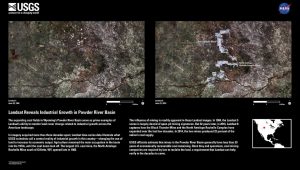

New images released earlier this summer by the U.S. Geological Survey illustrate the impact of industrial development on the high plains of Wyoming. Images from the Landsat satellite taken in 1984 and 2016 reveal before-and-after views of a landscape riven by the three largest coal mines in the country: Peabody Energy’s North Antelope Rochelle Mine, Arch Coal’s Black Thunder Mine, and Cloud Peak Energy’s Antelope Mine.

USGS Release

A USGS news release describes the images:

“The influence of mining is readily apparent in these Landsat images. In 1984, the Landsat 5 scene is largely devoid of open-pit mining signatures. But 32 years later, in 2016, Landsat 8 captures how the Black Thunder Mine and the North Antelope Rochelle Complex have expanded over the last few decades. In 2014, the two mines produced 22 percent of the nation’s coal supply.

“USGS officials estimate that mines in the Powder River Basin generally have less than 20 years of economically recoverable coal remaining. Once they end operations, coal mining companies are required by law to reclaim the land, a requirement that Landsat can help verify in the decades to come.”

Impact of Mining, Need for Reclamation

According to records maintained by the U.S. Office of Surface Mining Reclamation and Enforcement (OSMRE), the three mining operations pictured have disturbed 62,988 acres of grassland. That’s just shy of 100 square miles. Mining overlaps the Thunder Basin National Grassland, controlled by the U.S. Forest Service with grazing managed by the Thunder Basin Grazing Association.

Questions remain about whether the companies will successfully reclaim their mine sites. For starters, all three mines are far behind on bond release, the three- or four-phase process that allows operators to diminish cleanup liability as reclamation work proceeds. To achieve bond release, operators must provide data demonstrating they have met reclamation standards. As such, bond release is the only objective measure of reclamation success.

Of the three mines, only Black Thunder has achieved any Phase II bond release, recording 4,078 acres last year. Similarly, North Antelope Rochelle and Antelope have not achieved a single acre of Phase III final bond release, despite three decades of operations. Black Thunder has achieved only 318 acres of Phase III bond release.

What’s more, Peabody and Arch are currently in bankruptcy court, while their Wyoming mines are self-bonded. This means they have not supplied state or federal regulators with any collateral to ensure mine cleanup. Although each company has struck a deal with the State of Wyoming to cover less than 20% of cleanup liabilities during bankruptcy proceedings, OSMRE recently determined that a similar deal between Alpha Natural Resources and the State of Wyoming violated federal regulations. As it emerged from bankruptcy, Alpha agreed to replace its self-bonds in Wyoming with conventional guarantees, such as surety or collateral bonds.

Coalbed Methane Visible, too

Notice in the 2016 image, too, the footprint of a spider’s-web of coalbed methane wells surrounding the coal mines. That industry boomed in the Powder River Basin between 2000 and 2010. During the boom, many landowners faced conflicts with gas companies over surface access, produced water disposal, and eminent domain issues.